RouteScore API: Insurance

What is RouteScore API?

Our risk-scoring algorithm is transforming how the industry evaluates and manages cargo theft risk. By providing lane and load-level insights, shippers and brokers can align their own carrier and driver security scores with high-risk routes. This proactive approach is driving carriers and drivers to elevate their security practices while brokers, retailers, and manufacturers implement additional measures such as tracking devices, security escorts, driver teams, and relays to ensure safer cargo transport. Note: We do not provide carrier security scores; it's up to the end user to build and create them.

Added Benefits

- Dynamic Pricing: Adjust premiums based on the risk score. High-risk shipments can be charged higher premiums, while low-risk shipments can be incentivized with lower premiums.

- Customized Policies: Offer tailored insurance policies that reflect the specific risk associated with each load, ensuring appropriate coverage levels.

- Risk Assessment Criteria: Integrate the risk score into the underwriting process to assess potential clients and shipments more accurately. Use the reasons behind the scores to refine underwriting criteria.

- Preferred Clients: Develop a list of preferred clients or carriers with lower average risk scores, offering them better rates and terms due to their lower risk profile.

- Additional Security Measures: Require or recommend additional security measures (e.g., GPS tracking, security escorts) for high-risk shipments as a condition for coverage.

- Conditional Endorsements: Provide endorsements for high-risk shipments that mandate specific precautions (e.g., no stops at theft-prone truck stops) to maintain coverage.

- Claims Adjustment: Adjust claims processes based on the risk score, expediting claims for low-risk shipments and performing more rigorous investigations for high-risk ones.

- Risk Mitigation Consultation: Offer advisory services to clients, helping them understand their risk scores and providing recommendations to lower their risk (e.g., route adjustments and better security practices).

- Training and Education: Conduct training sessions for clients on best practices for reducing cargo theft risks, emphasizing the factors influencing the risk score.

By leveraging the detailed risk scores and their contributing factors, each stakeholder can implement targeted strategies to reduce the likelihood of cargo theft and enhance overall supply chain security.

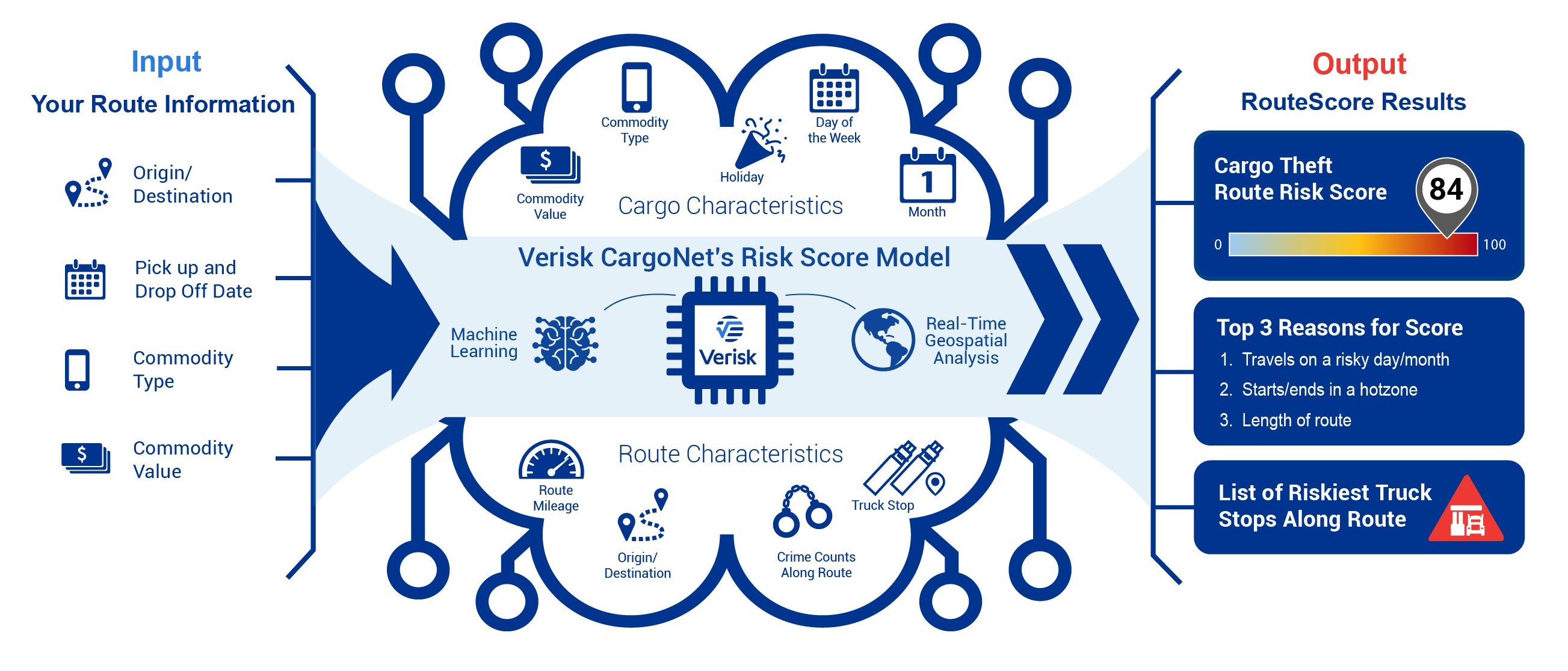

With 15+ years of accumulative national cargo theft data, Verisk data scientists developed an AI solution that powers risk scoring before a trip starts based on various factors such as: type of commodity hauled, value, origin and destination, travel distance, day of the week, truck stop risk, holidays, seasonality, etc.

The RouteScore model assesses risks related to theft along a specific route. The risk score has a range of 0-100, with 100 being the highest risk. It is designed to help supply chain and insurance companies better understand their risk of cargo theft and provide them with decision-making support to better protect cargo from being stolen.

Robust Data, Powerful Analytics, Better Decisions:

- Provides tangible insight from historical theft trends

- Allows you to make data-driven decisions

- Illustrates best practices and gives you and your customers a comfort level

- Mitigate cargo theft insurance claims and stabilize your premium